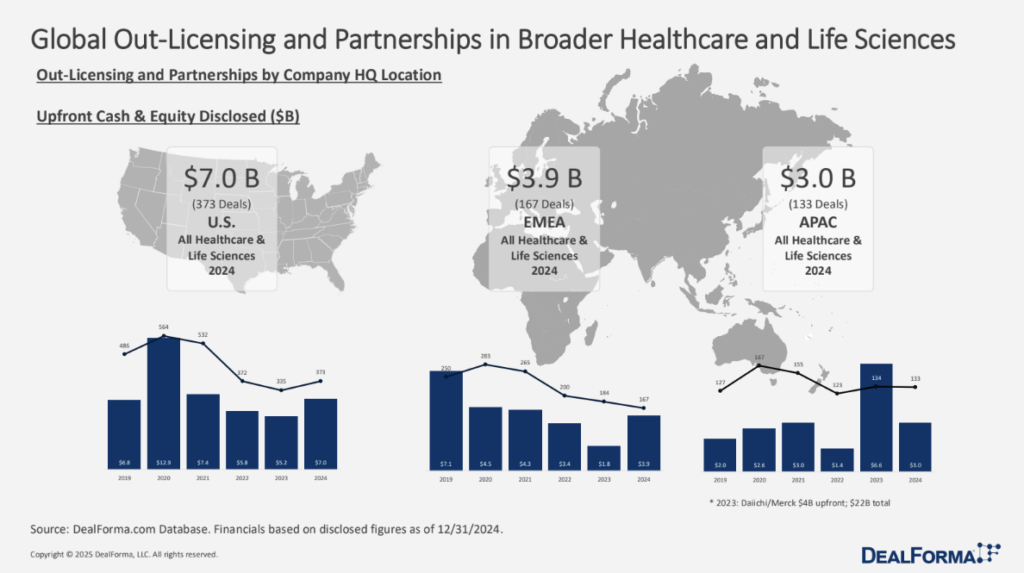

In 2024, the biopharma sector saw a remarkable resurgence in activity, driven by global licensing and partnerships. The U.S. led the market with $7.0 billion across 373 deals, followed by the EMEA with $3.9 billion in 167 deals and the APAC region with $3.0 billion in 133 deals). This increase indicates continued interest in strategic collaborations and licensing agreements, signaling a robust environment for innovation and growth.

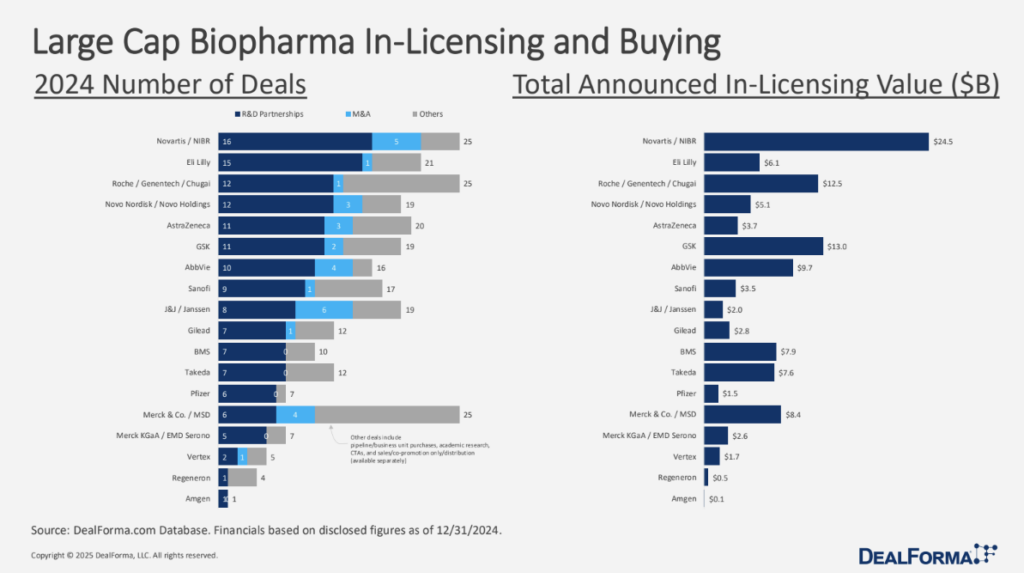

Large-cap biopharma companies were highly active in 2024, though individual deal sizes were smaller. In total, 263 deals were signed, with 146 being in-licenses and 30 being classified as acquisitions with a combined deal value of $113 billion. Upfront payments for mergers and acquisitions (M&A) amounted to $45 billion, reflecting a strategic shift towards securing valuable assets early in their development cycle.

Notable transactions included J&J’s $13.1 billion Shockwave acquisition and Gilead’s $4.3 billion CymaBay deal. These deals indicate a trend towards smaller, yet strategically significant acquisitions aimed at bolstering pipelines and mitigating the risks associated with loss-of-exclusivity (LOE).

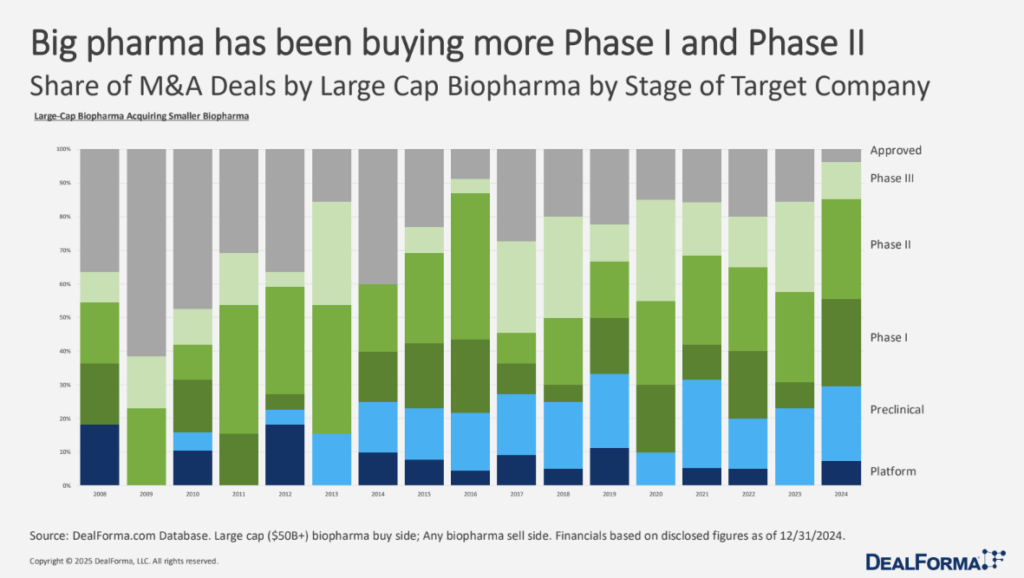

Among the key players in biopharma in-licensing, Novartis led the charge with $24.5 billion across 16 deals, followed by Eli Lilly with $6.1 billion in 15 deals, and Roche/Genentech with $12.5 billion in 12 deals. This trend highlights the growing importance of in-licensing as a strategy for large-cap biopharma companies to access innovative new therapies and expand their portfolios. One emerging trend is the increasing willingness of big pharma to place higher upfront values on Phase I assets, signaling strong confidence in the potential of early-stage projects.

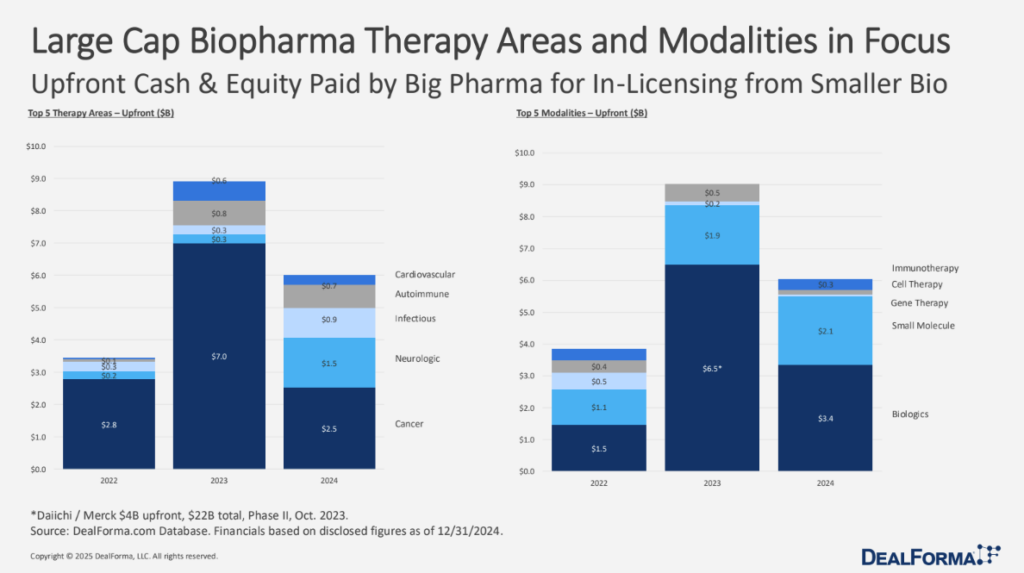

Investment was concentrated in biologics, small molecules, and immunotherapies, particularly in oncology. Upfront payments surged in oncology and neurological therapies, reflecting strong investor confidence in these sectors.

Oncology partnerships remained a priority, with median upfront payments rising from $25 million in 2023 to $38 million in 2024. Additionally, antibody-drug conjugates (ADCs) deals saw growing investments, with total deal values hitting $49.4 billion in 2024.

Big pharma continued to invest heavily in discovery platforms, with licensing deals increasingly targeting early-stage assets. AI-driven drug discovery saw a sharp increase, with 89 deals amounting to $11.1 billion in total value. These trends underscore the sector’s commitment to leveraging cutting-edge technologies to drive innovation and improve therapeutic outcomes.

Venture investment in life sciences reached $48.4 billion in 2024, with biopharma securing $27 billion.

U.S. hubs such as San Francisco with$18.7 billion and Boston with $15.8 billion remained dominant.

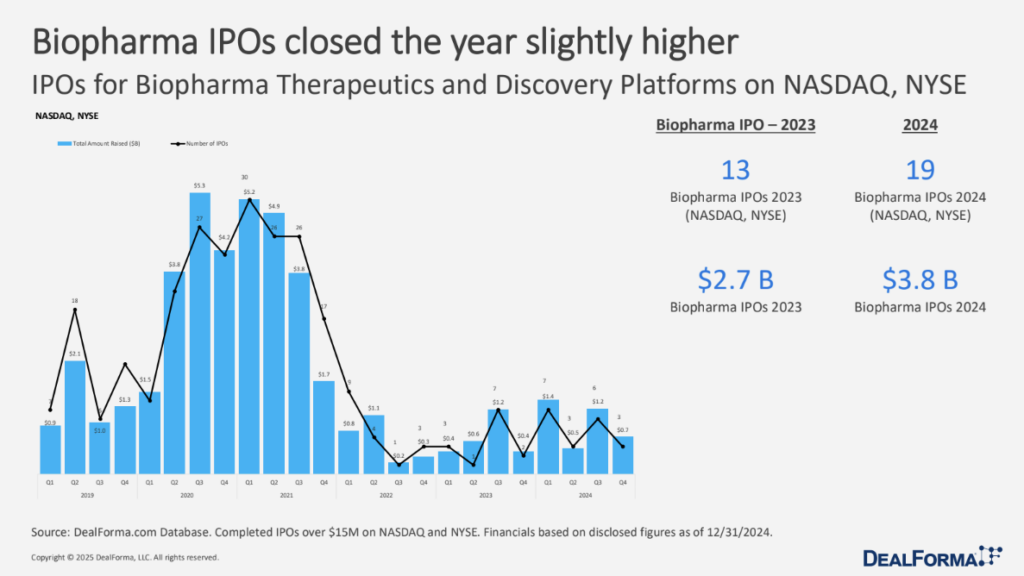

Biopharma IPOs rose to 19 in 2024 (up from 13 in 2023), raising $3.8 billion. Private investment in public equity (PIPEs) and follow-on offerings remained strong, with total PIPEs reaching $6.4 billion and follow-ons exceeding $15.2 billion.

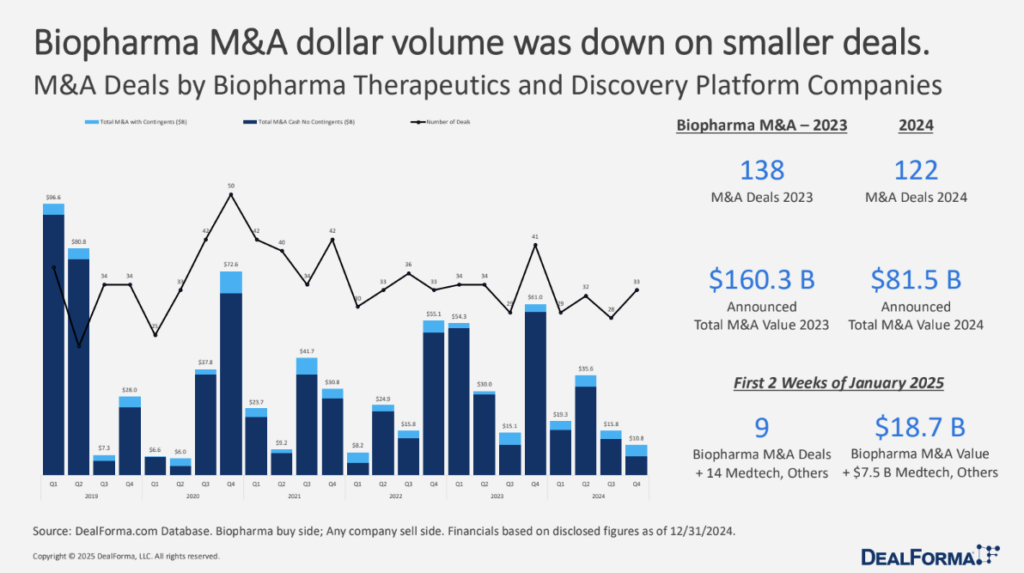

M&A activity declined in total deal value, dropping to $81.5 billion in 2024 from $160.3 billion in 2023. However, early-stage acquisitions increased, with big pharma targeting Phase I and Phase II assets more aggressively to bolster pipelines ahead of loss-of-exclusivity (LOE) risks.

Looking ahead to 2025, the biopharma industry is expected to prioritize early-stage R&D and high-value Phase I assets. Private biopharma companies are likely to stay private longer due to larger venture rounds, while IPO activity is anticipated to remain slow. Strategic partnerships and licensing deals will continue to play a critical role in drug development, with AI-driven platforms expected to attract increased investment.

Biopharma dealmaking in 2024 saw a resurgence in licensing, venture capital investment, and R&D partnerships. While M&A deal sizes were smaller, early-stage assets garnered strong interest from major pharmaceutical companies. Looking ahead to 2025, innovation sourcing and strategic collaborations will be essential for shaping the future landscape of biopharmaceutical development.

Information and Infographic Source: DealForma.com Database. Financials based on disclosed figures as of 12/31/2024.

20 years of experience in international business development in the pharmaceutical industry. Head of commercial operations and business development for Bristol-Myers Squibb in 16 Latin American countries. Global management consultant. Speaks French and Spanish fluently. Completed nine transactions in global markets in the past three years.